A coalition of European banks made an announcement about the launch of a new stablecoin pegged to the euro to provide an alternative to the US dollar-pegged stablecoins. An analyst termed this initiative as Europe launching its own “Airbus.” He said, ‘It’s less about efficiency and more about sovereignty’

A consortium of 10 European banks, which consisted of BNP Paribas, ING, UniCredit, Banca Sella, KBC, DekaBank, Danske Bank, SEB, Caixabank, and Raiffeisen Bank International, established a new company by the name Qivalis to launch a stablecoin pegged to the euro. The stablecoin is proposed to be launched by the company in mid-2026.

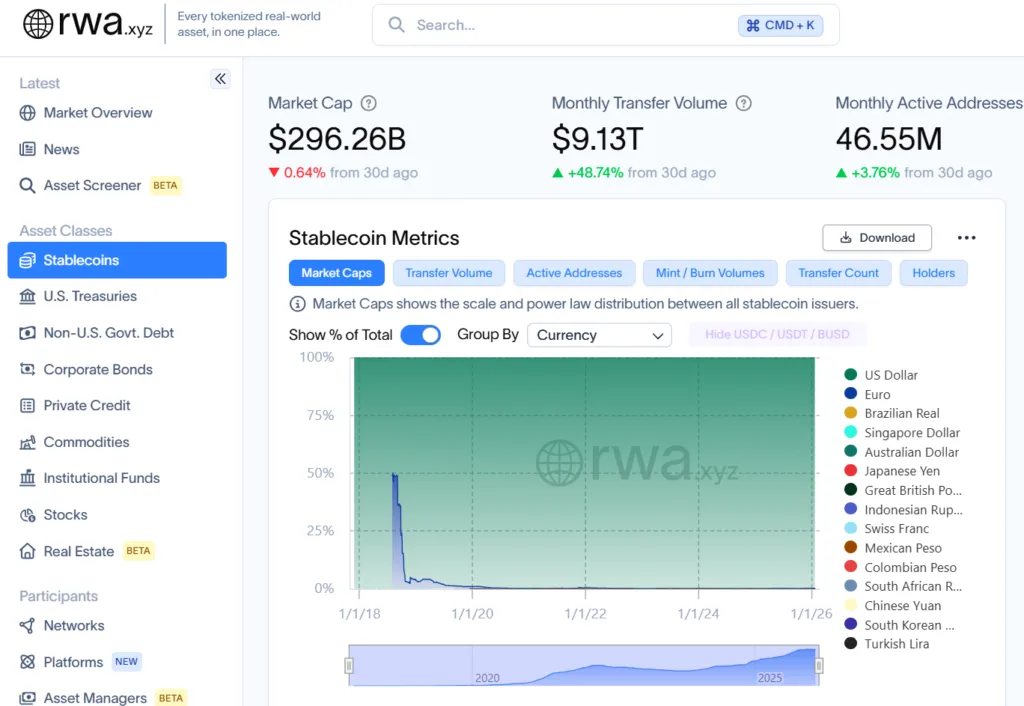

Analyst Lavneet Bansal stated that the global stablecoin market is dollar-only territory. USDT and USDC dominate liquidity. Drawing examples, Bansal reminisced about how Tether launched USDAT, and even DeFi innovators like MakerDAO and Ethena steer clear of euro experiments.

Although Europe has tried to change that before, Bansal stated that the ECB’s digital euro has been stuck in pilot mode for years, while private euro stablecoins like Monerium, Angle, and Stasis never broke through, leaving a vacuum, which banks want to fill.

However, “the upside: a consortium like this has reach. If every member integrates the token into their own apps, wallets, and settlement rails, a euro stablecoin could have distribution power from day one.”

He mentioned that this initiative was less about efficiency and more about sovereignty. Europe is trying to create its own “Airbus moment” for payments, a safe, regulated counterweight to U.S. stablecoins. However, the hard part isn’t compliance. It’s adoption.

Without real-world liquidity, even ten banks can end up launching just another well-meaning European project that arrives too late, stated Bansal.

Among the top-tier executives of Qivalis, Jan-Oliver Sell, former CEO of Coinbase Germany, will serve as chief executive, while Howard Davies, former chair of NatWest, is appointed as chair. The Amsterdam-based firm plans to hire 45 to 50 employees over the next two years, with one-third of positions already filled, according to the company.

But with the formation of a new private entity, regulators fear that the stablecoins could divert funds away from regulated banking institutions, affecting monetary policy.

Qivalis is seeking an Electronic Money Institution license from the Dutch central bank, as this license gives the regulatory approval to allow companies to issue electronic money (e‑money) and provide related payment services legally.