The macroeconomic market conditions are favoring crypto prices and altcoin season, as the Federal Reserve is largely expected to hold the rates steady. With the rates held steady, analysts expect Bitcoin miners to start the 2026 capex cycle, and this will eventually funnel into altcoins.

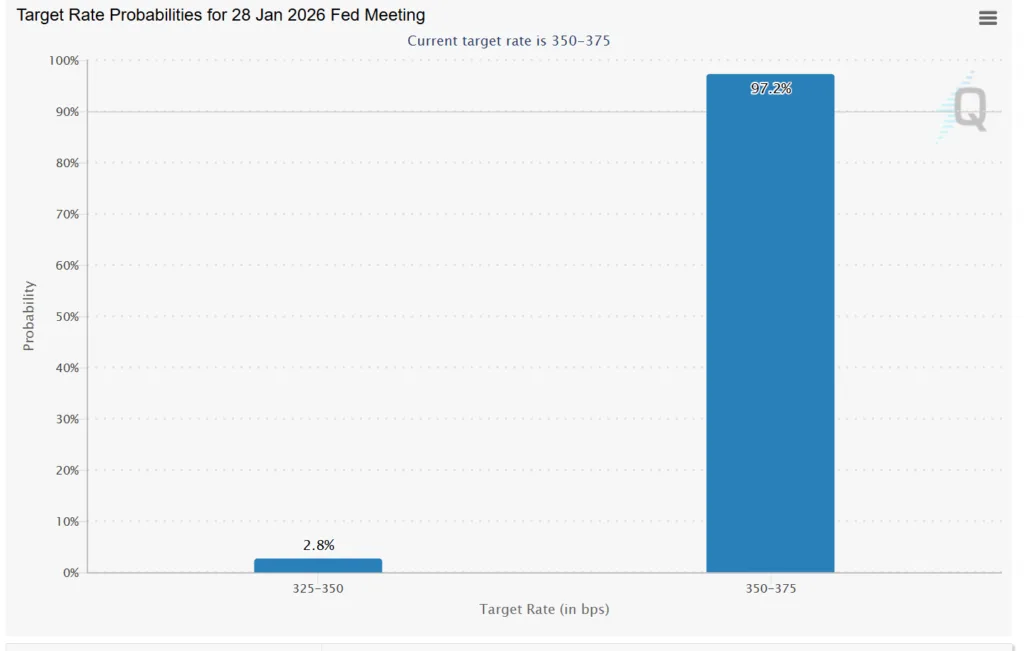

The Federal Open Market Committee (FOMC) will gather for the first time in 2026 to decide on the interest rates. According to CME Group’s FedWatch tool, the odds of the Federal Reserve keeping the rates steady have risen to 97.2%.

The Fed holding interest rates at current levels signals to markets that we’re in a holding pattern.

Chief Revenue Officer at Compass Mining, CJ Burnett

“It may be some time before we see another cut, but this also means Bitcoin miners can begin the 2026 capex cycle with confidence that financing costs will likely stay steady for the near term.”

The capex cycle, or the capital expenditure cycle, is a period where companies invest in long-term productive assets and other equipment. And for 2026, the main attention is on advancing AI, cloud infrastructure, data centers, and crypto. As such, Burnett thinks that Bitcoin miners may also spend their capital on productive assets.

When the capex booms, it means companies are equipped with instruments that could enhance the productivity in the future. This will translate into a healthy economy, lowering the inflation, without the Fed needing to stimulate with rate cuts.

With pressure off the Fed to hold inflation, the liquidity expectation has turned bullish, and then it reflects into risk assets, which at the latter stages will rotate into altcoins.

CapEx boom → higher productivity → lower inflation pressure → Fed pauses → liquidity expectations turn bullish → risk assets reprice → alts catch the late-cycle bid

Summing it up, analyst Lavneet Bansal told AltCoinDesk:

With rates expected to stay unchanged, markets are likely to focus less on the decision itself and more on the Fed’s guidance. For crypto, this usually means near-term volatility, with Bitcoin holding up better than Ethereum and altcoins as liquidity remains tight.

Bansal expects that the bigger move will come only once there is clearer confidence on when rate cuts actually begin.