Gold beat Ethereum while racing to the psychologically important level of $5,000. With brewing geopolitical tensions surrounding the market, investors rotated their funds into precious metals. However, an analyst stated that comparing Ethereum with gold is like comparing apples and bananas.

An ounce of gold had been trading under the $3,400 resistance level since April 2025. However, once it broke above this resistance level, it took off. From just under $3,500, the precious metal rose above the $5,000 level almost parabolically within 4 months.

Geopolitics the main catalyst behind the rally

The rising geopolitical tension was the main force that drove the investor to rotate their funds into a safe haven like gold. US President Donald Trump was threatening to slam tariffs on the NATO countries if the U.S. did not gain control over Greenland, which is part of Denmark.

But that is just one part of the story. On the other hand, the president also threatened to slap Canada with 100% tariffs if it made a deal with China.

When there are threats of tariffs, it could dismantle the market’s equilibrium, and the prices will be all over the place. In such situations traders usually opt for less volatile assets like gold and silver.

Gold is overbought; will it crash?

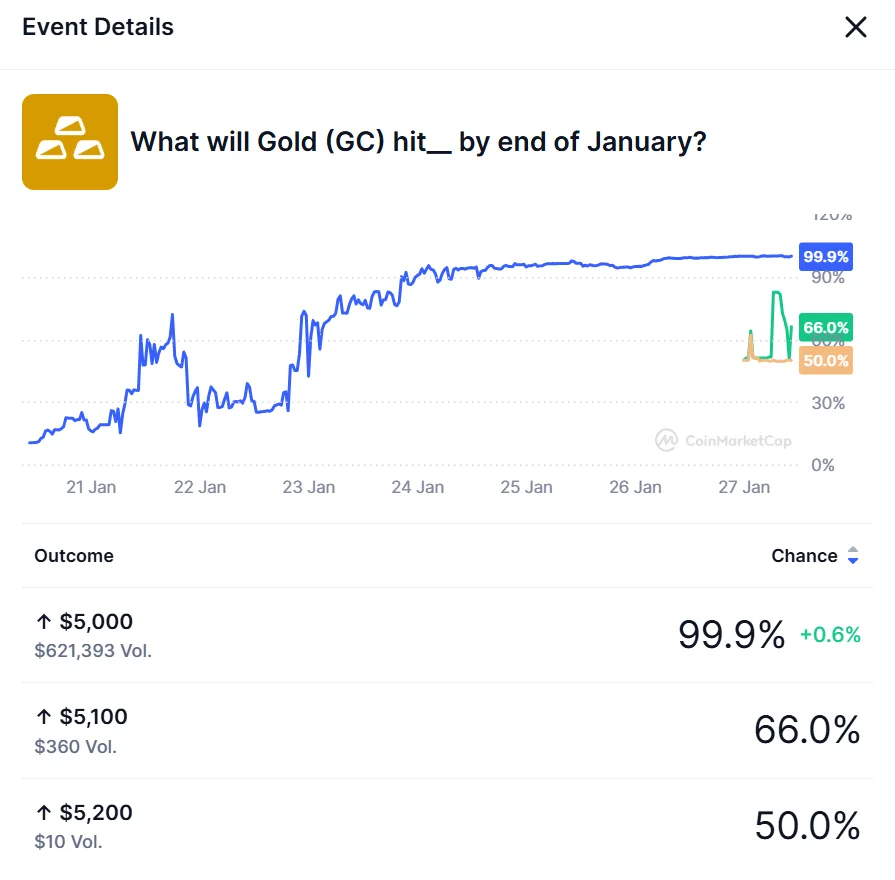

According to prediction markets, 99% of participants think that gold will hold above the $5,000 price level, although technically it is in the overbought region. According to analysts’ forecasts from reliable news platforms, gold prices are expected to hit $6,000.

When gold was thriving, Ethereum lost its shape, which was molding it into a bullish ascending triangle. The coin crashed below the lower trendline and below the $3,000 psychological support level.

Although gold and Ethereum are compared against each other on the basis of what will hit the $5,000 level first, according to analysts, they are incomparable based on their nature.

Gold and ETH are not comparable assets. We portray BTC as a digital equivalent of gold. And with the macroeconomic conditions along with geopolitics, BTC is not moving up; gold is. People still treat BTC as a risk asset. So comparing gold and ETH is like comparing apples to bananas.

Analyst Lavneet Bansal