Hyperliquid’s native token, HYPE, broke above a major resistance level after the open interest (OI) hit a new all-time high. The OI hit a new all-time high with the introduction of Hyperliquid’s HIP-3, also known as “Builder Deployed Perpetuals. “

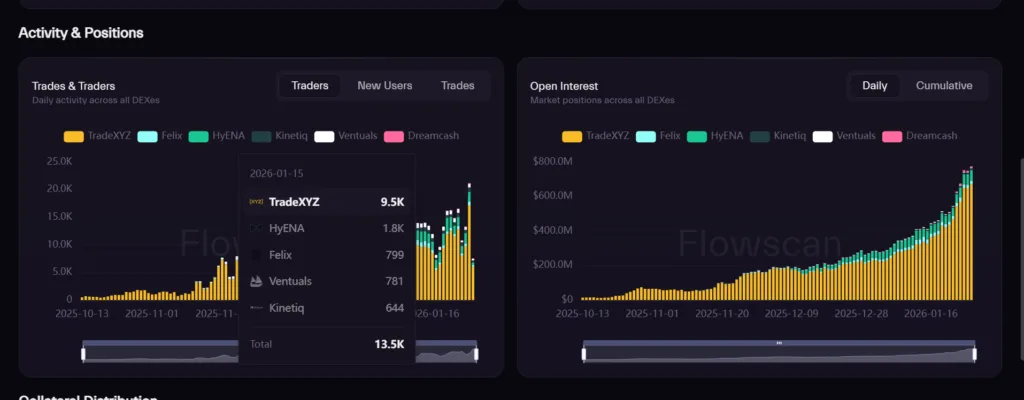

The HYPE OI spiked after the introduction of the HIP3, a feature that lets any person who stakes more than 500,000 HYPE create a perpetual market. The OI hit a new all-time high of $790M, driven by the permissionless market creation infrastructure.

When the open interest increases, it shows that that many perpetual contracts linked to commodities are being opened.

HIP-3 nearing $800 million in open interest shows real positions building on builder-deployed markets, not just short-term trading. Most of that activity is coming from commodity-linked perps, which tells you traders are using Hyperliquid to express macro views, not just trade crypto.

Lavneet Bansal, crypto analyst

However, Bansal raised concerns, saying “the next test is whether this stays concentrated around a few deployers or broadens out as more markets launch.”

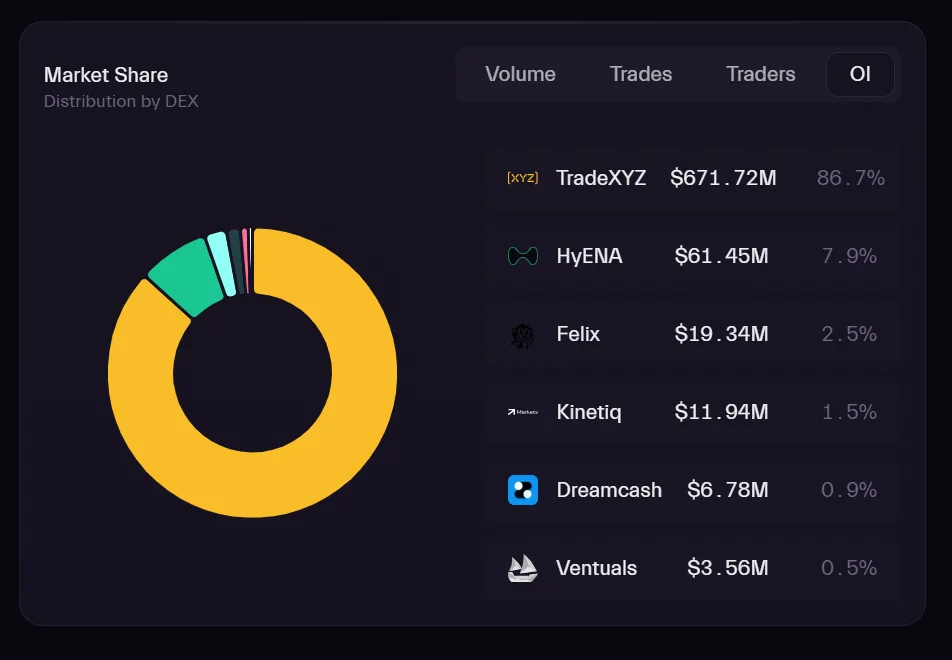

Currently, Tradexyz, a decentralized perpetual trading platform, seems to have the monopoly in the market. The platform recorded an OI of more than 670 million, capturing around 85% of the market share.

With the spike in the OI, the price of the HYPE token rammed past the 50-day moving average while the broader crypto market was suffering due to geopolitical tension. This breakout comes after more than 3 months of trading below this level.

HYPE targets $35

With HYPE now breaking above the 50-day moving average, which is at $27, the next target should be $35.

The falling wedge shown in the chart above usually produces a spike; that is equivalent to the height of the wedge at its widest point. Think of it like a coiled spring, which, when released, expands to its full length.

Inside this pattern, sellers have control, but their strength continues to drop. With every price, buyers step in sooner to prevent deeper declines.

Trading volume often decreases as the pattern progresses, signaling that selling pressure is fading and the market is “coiling” in anticipation of a potential reversal. As such, when it breaks out, HYPE will target $35.