Hyperliquid’s trading volume, social volume, and price spiked drastically following the introduction of the platform to prediction markets. The addition of outcome-based trading is less about prediction markets and more about expanding how risk can be traded on-chain, said an analyst.

The Hyperliquid community was excited about the launch of the HIP-4, a major protocol upgrade that introduces what the team calls “outcome trading. Social media platforms were dominated by the community talking about the coin. The trading volume and the prices were through the roof.

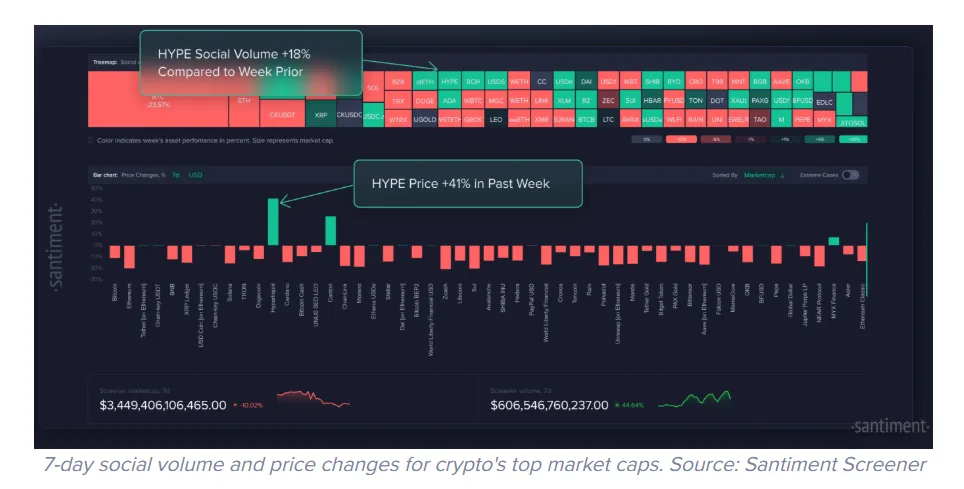

Santiment, a crypto analytical tool, stated that the crypto community has reacted strongly to the Hyperliquid news. Traders and speculators have bid up the native token HYPE sharply after the announcement.

HYPE spikes by more than 70% in the last week

Within the last 24 hours alone, the price of HYPE jumped roughly +16%, reflecting traders’ positive sentiment about HIP-4’s potential to expand product offerings.

“Over the past two weeks, since hitting a local bottom on January 19, 2026, HYPE has climbed about +71%, outpacing altcoins that have overwhelmingly spent the last week in the red. We’re also seeing discussion rates on the asset rising by +18% compared to last week,” read an excerpt from Santiment.

“Hyperliquid’s move into outcome-based contracts is less about prediction markets and more about expanding how risk can be traded on-chain. These products remove leverage and liquidations, which could attract users who want fixed downside instead of high-stress perps trading.”

Market Analyst Lavneet Bansal

He mentioned that if it succeeds, it would broaden Hyperliquid’s appeal beyond pro traders without increasing systemic risk. However, the real test will be whether this drives sustained usage, not just excitement around the announcement, Bansal mentioned.

With the HIP-4 protocol upgrade, the community can wager on sports, political, and other event outcomes without risk (leverage) and forced selling.

HIP-4 upgrade adds a bounce to the prices

The HIP-4 added an extra bounce to HYPE prices, which were already surging out of the bullish wedge pattern. With this, the external push, HYPE prices blew up; the coin crossed above the long-term moving average (200-day MA), which is a bullish signal.

If the HYPE prices follow the conventional breakout rules where the prices spike by the height of the widest part of the wedge, then the coin will cross above $40.