As Jerome Powell’s term as the Chairman of the Federal Reserve comes to an end this May, President Trump announced the new Fed Chair today. Even before Trump officially announced the new Fed Chair, Kevin Warsh stood a better chance of being enthroned as chair, according to prediction markets. Analyst stated that appointing Warsh means it’s more about credibility and control and less about quick rate cuts.

As Jerome Powell, the Fed Chairman, hangs up his boots, President Trump picked his replacement, Kevin Warsh. Warsh is no newbie to this front, as he has more than 5 years of experience under his belt, serving as a member of the Federal Reserve Board of Governors from 2006 to 2011. During his time there, he was involved in policy decisions during and after the 2008 financial crisis.

On the other hand, Powell, the legendary chair, who held this position for 8 years, will step down after he assumed duties on February 5, 2018, when he was first appointed by Trump. Later on, in 2022, when his first term was about to end, Powell was re-elected, elongating his tenure to 8 years.

Kevin Warsh takes over Fed Chair postion

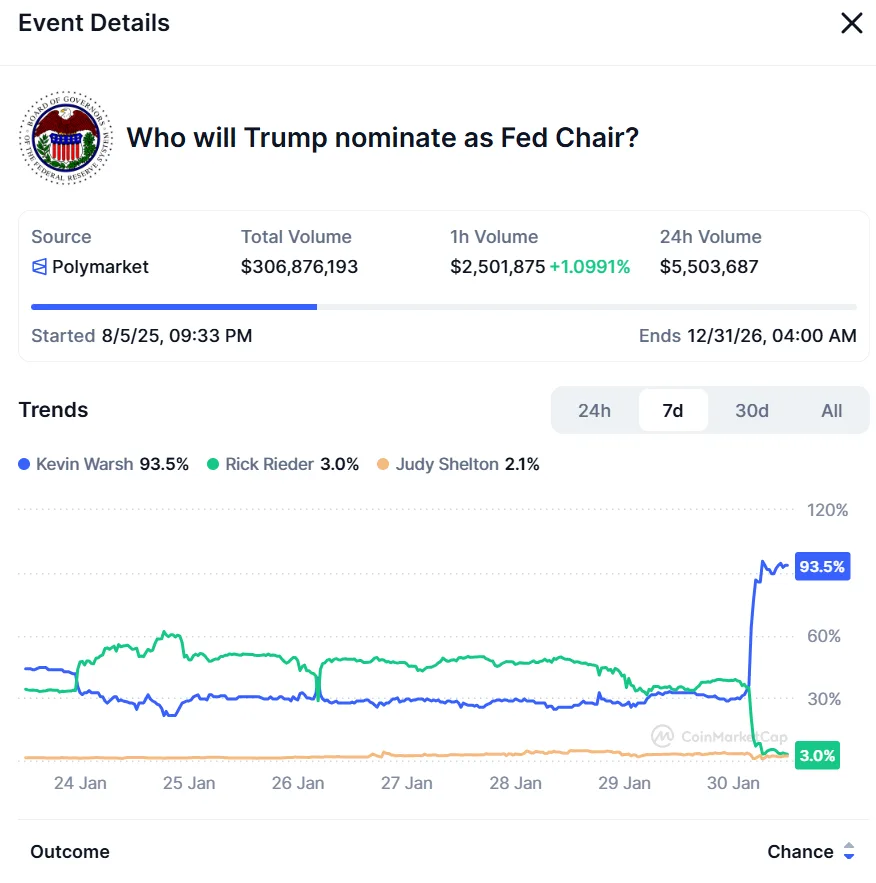

Trump’s pick did not come as a surprise, as the prediction markets increased the odds of Trump going with Kevin Warsh by 93.5%. There is a stark difference between Warsh and Rick and Judy when the odds are compared. Warsh is head and shoulders above the rest, while Rick and Judy hardly touched double digits.

Powell cut the interest rates by 25 basis points three times each during 2025, but the crypto markets did not flinch. As the rate cut came towards the latter end of the year, Trump nicknamed Powell as Mr. Late, and at one point, Powell’s position was in jeopardy. However, the chair blamed Trump’s volatile tariffs, which stole his freedom to slash rates earlier.

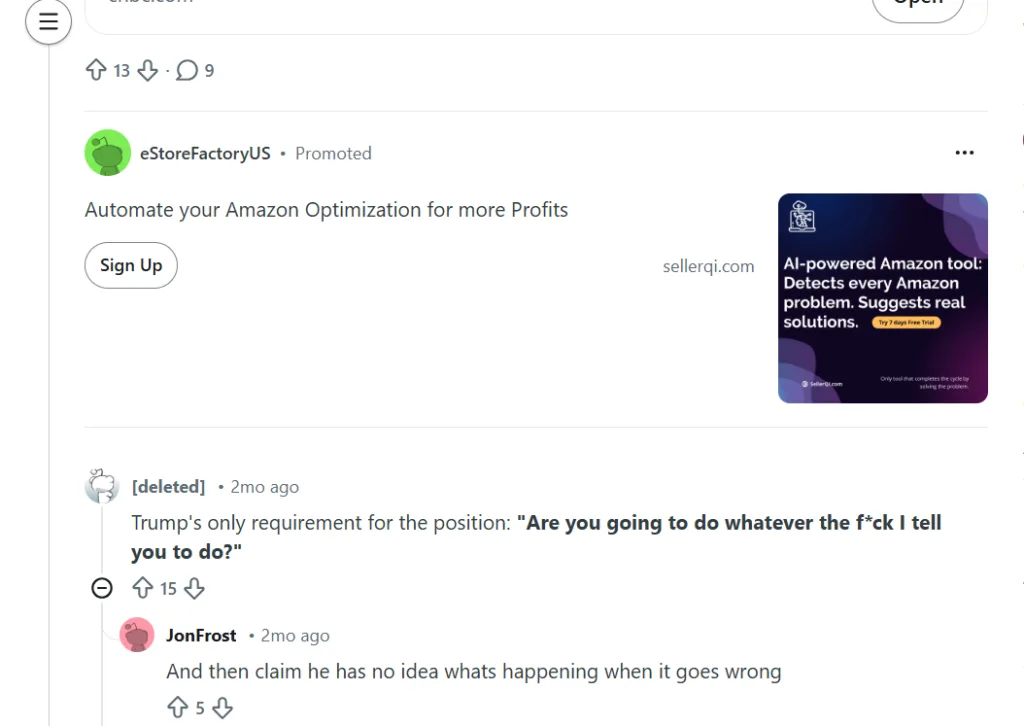

Commoners blast the president on Reddit

Some people were blasting Trump on Reddit for his selection. One such comment read, “Trump’s only requirement for the position: ‘Are you going to do whatever the [expletive] I tell you to do?’

Another respondent said, “Trump doesn’t give two [expletive] about helping the economy where it is hurting the little guy. The ONLY reason he wants lower rates is that it makes it less expensive to pay on his loans.”

Trump has been openly pushing for lower interest rates, so nominating someone like Kevin Warsh feels a bit contradictory at first glance. Warsh is seen as more disciplined on inflation and not someone who would cut rates just because of political pressure.

Analyst Lavneet Bansal

This goes on to say that it suggests the Fed may still prioritize independence, even under a Trump pick, said Bansal. Moreover, he projected that the markets seem to be reading the proposal as less about quick rate cuts and more about signaling control and credibility.