The Trump administration has decided to let crypto step into one of the most traditional corners of finance: home mortgages. For the first time in U.S. history, the Federal Housing Finance Agency (FHFA) has ordered Fannie Mae and Freddie Mac to begin counting cryptocurrency as part of mortgage applicants’ financial assets.

On the surface, it looks like modernization. In reality, it is a gamble with generational consequences.

When the blockchain meets the brick wall

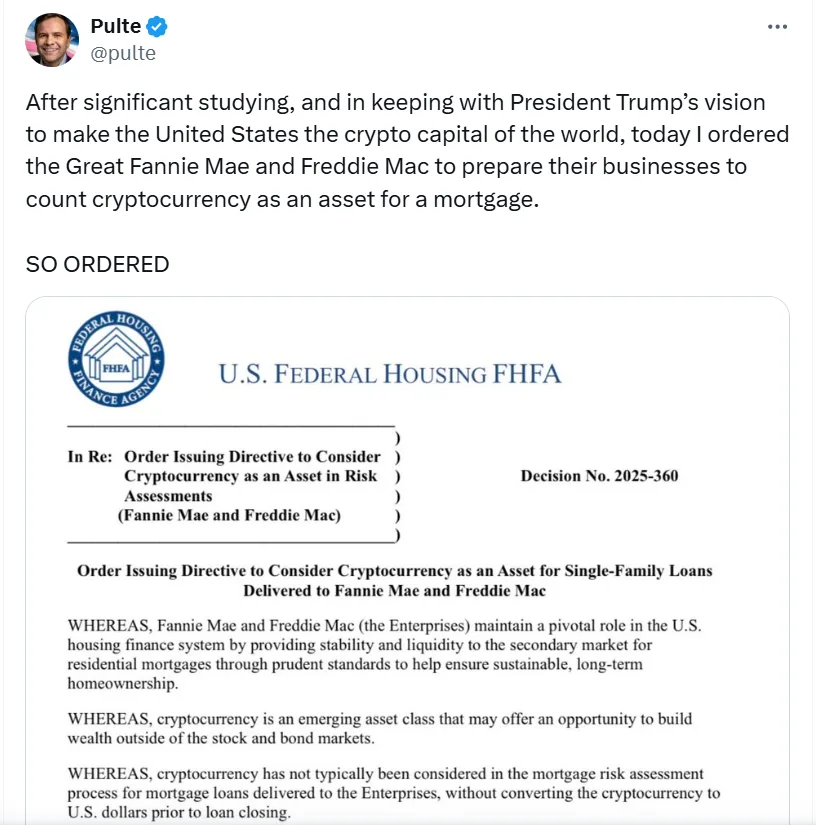

Bill Pulte, director of the FHFA, announced the order on X, posting an image of the official directive stamped with the agency’s seal and the phrase “SO ORDERED.” His message was clear: this is part of President Trump’s vision to make America the “crypto capital of the world.”

Under the directive, both Fannie Mae and Freddie Mac are to develop systems that recognize crypto holdings such as Bitcoin, Ethereum, stablecoins, and beyond when assessing mortgage risk. In simpler terms, if you hold digital assets, you could soon list them alongside your stocks and savings when applying for a home loan.

The rationale is simple: 15 percent of Americans now hold some form of cryptocurrency, according to recent surveys. Ignoring those assets in financial assessments no longer fits a world where wealth exists beyond bank accounts.

But here is the catch. Crypto does not behave like cash.

Risk, reward, and regulatory roulette of the Trump administration

Economist Daryl Fairweather of Redfin allegedly told CNBC that lenders already manage volatile assets like stocks, so incorporating crypto “should not be too difficult.” That may sound reasonable on paper, but the mortgage market has a far stricter relationship with volatility. A 20 percent drop in Bitcoin prices could instantly erode a borrower’s asset base, reshaping their loan-to-value ratio overnight.

Supporters within the Trump administration frame this move as financial inclusion, a way for crypto investors, often self-employed or globally based, to access home financing. Senator Cynthia Lummis, a longtime crypto advocate, even introduced a bill to codify the FHFA directive into law, ensuring it remains beyond the lifespan of a single presidency.

Yet, Democrats in the Senate see a familiar red flag. In July, several senators called the FHFA proposal “risky,” warning that integrating unconverted crypto into mortgage underwriting could inject volatility into an already fragile housing market. Their letter asked for clarity on how these assets would be valued, verified, or insured against market shocks.

Those concerns echo the ghosts of 2008, when untested financial instruments were treated as stable collateral until the system collapsed under its own assumptions.

The political experiment behind the policy

This directive is more than a financial policy; it is a political statement. The Trump administration has consistently aligned itself with the pro-crypto movement, often portraying digital assets as symbols of American innovation and independence.

By embedding crypto into the DNA of housing finance, the administration is not just expanding asset definitions; it is testing how far Washington can stretch the boundaries of financial normalization.

It signals a future where your mortgage, your savings, and your decentralized wallet might all sit under the same institutional roof. Whether that is visionary or reckless will depend on how regulators translate enthusiasm into oversight.

Crypto as collateral or catastrophe?

If done right, this could be the blueprint for a new era of digital wealth recognition. A well-regulated framework could allow lenders to verify on-chain holdings securely, account for volatility, and diversify risk models.

If done wrong, it could tether two unstable markets, crypto and housing, into a single feedback loop of speculative collapse. Imagine Bitcoin halving cycles dictating mortgage defaults, or a stablecoin depeg triggering a credit contraction.

This is where leadership will matter most. The Trump administration’s ambition to make the U.S. the crypto capital of the world can only succeed if innovation is matched with accountability.

A digital dream meets a paper reality

Crypto-backed mortgages mark the first major intersection between decentralized finance and the American dream. They represent both progress and peril, the promise of inclusion and the risk of contagion.

The question now is whether America is ready for a world where the same volatility that moves Bitcoin could move the housing market. Because once crypto enters the mortgage system, it is no longer just digital money. It becomes the foundation of real-world debt, and that is a bridge that, once crossed, cannot be unbuilt.