One of the leading decentralized finance (DeFi) protocols, Uniswap (UNI), is slated to undergo a major upgrade later this year, subject to governance approval. In a proposal published on November 10, Uniswap founder Hayden Adams unveiled the ‘UNIfication’ proposal, aimed toward increasing the usage of the native UNI token.

The UNIfication proposal at a glance

In a detailed post on the UNIfication proposal, Adams walked the community through the nitty-gritty of the UNIfication proposal. According to the Uniswap founder, the proposal aims to create a long-term model for the protocol’s rapidly developing ecosystem. The eventual goal is to increase protocol usage which, in turn, will drive UNI supply burn.

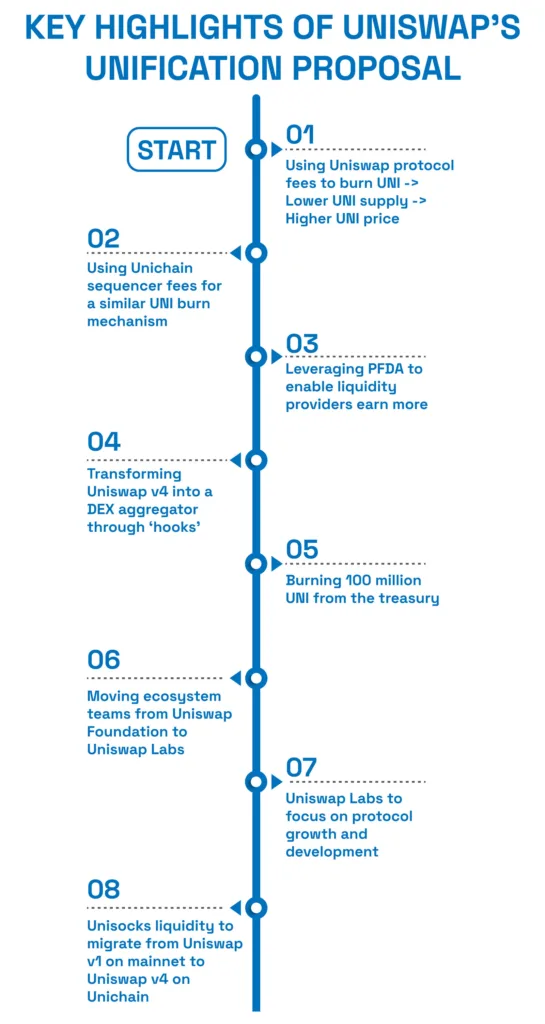

In his proposal on the Uniswap Governance Forum, Adams highlighted eight key points. The first is to turn on Uniswap protocol fees and use the fee to burn UNI token supply.

Using protocol fees to burn UNI token

Currently, Uniswap liquidity providers earn swap fees, while the protocol itself earns no revenue. As a result, all swaps are indirectly benefiting only liquidity providers. However, under the proposed change, a portion of all swap fees will be directed toward the protocol. Subsequently, this portion of fees will be used toward buying and burning UNI in the market.

Similarly, the Unichain sequencer fees will be used toward buying and burning UNI token. For the uninitiated, Unichain is Uniswap’s L2 network, launched about nine months ago. The proposal states that all Unichain fees – after accounting for L1 data costs and deducting 15% to Optimism (an Ethereum L2 solution) – will be used in the burn mechanism.

As a result of buying and burning UNI in the market, the total supply of the token will steadily go down. The mechanism ties Uniswap’s protocol usage directly to the price of the token, as a lower supply will likely put upward price pressure on the token.

Innovation in the fee mechanism for MEV internalization

Adams unveiled the Protocol Fee Discount Auction (PFDA), an innovative approach to improve liquidity provider performance. PFDAs are geared towards introducing a new stream of protocol fees by internalizing Maximal Extractable Value (MEV) that usually goes to searchers or validators.

To explain, MEV refers to the maximum possible profit that can be extracted by block producers – including miners, validators, and searchers – by including, excluding, or rearranging the order of blocks in a transaction. MEV is earned in addition to standard block rewards. Ultimately, the PFDA will help the Uniswap protocol capture MEV that used to otherwise leak to bots.

Transforming Uniswap v4 into an on-chain aggregator

One of the several new features to be introduced in Uniswap v4 is ‘hooks’, which aim to transform Uniswap from a single decentralized exchange (DEX) to a DEX aggregator. Hooks’ advanced logic will enable routing of token swaps across different DEXs, not just Uniswap pools.

Hooks will help Uniswap earn additional fees from the external liquidity it routes to. The overall effect is that as an increasing number of trades go through Uniswap, the protocol will earn more fees, and more UNI tokens will be burned, leading to greater supply scarcity and potentially higher price for UNI.

Burning 100 million UNI from the treasury

Another exciting component of the proposal is retroactively burning as many as 100 million UNI tokens from the DEX’s treasury. The move is symbolic, as it aims to show that if the fee mechanism had been put into place earlier, then the total UNI supply would already be significantly lower.

Notably, 100 million UNI tokens represent 10% of the total 1 billion supply. By burning such a big proportion of the total supply, the UNI token may see rapid price appreciation. The token is already up more than 40% over the past month.

Uniswap Labs to steer ecosystem growth

The last component of the proposal talks about the movement of Uniswap Foundation activities to Uniswap Labs. Uniswap Labs will spearhead all Uniswap ecosystem developments – including funding, governance support, and other related functions.

Importantly, Uniswap Labs will eliminate all fees on the protocol’s interface, API, and wallet. While these offerings already aid in bringing significant traction to the protocol, the removal of all fees is likely to make them even more competitive. As a result, it will benefit not only the liquidity providers but also the rest of the Uniswap ecosystem.

Summing it up

To conclude, Uniswap’s UNIfication proposal is ambitious, as the majority of the comments on the post indicate that the community had been expecting something similar for a long time. That said, some delegators raised concerns about actual incentive alignment between Uniswap Labs, Foundation, and the protocol.

Recent UNI price action confirms that overall, the wider DeFi community views the UNIfication proposal with significant enthusiasm. Uniswap’s UNI token has surged 51% over the past week, climbing to $7.98 at the time of writing. Despite the strong rebound, UNI remains about 82% below its record high of $44.92 set in May 2021 – leaving plenty of potential upside if market momentum continues.