When price feels boring, structure starts talking, and it often whispers before it shouts an XRP price breakout. XRP has started 2026 in a way that makes casual traders roll their eyes. Santiment says XRP is down about 4% since the start of the year, yet the number of so-called “millionaire wallets” is rising again for the first time since September 2025. The headline number is clean: a net of 42 wallets holding at least 1,000,000 XRP have “returned to the ledger.”

That combination, weak price and improving big wallet count, is exactly the kind of split that tends to go viral because it feels unfair. The chart says “slow,” and the on-chain data says “someone is preparing.” The only honest takeaway is this: the ingredients for an XRP price breakout are forming, but the market has not decided on the timing yet.

Translating Santiment’s phrase “millionaire wallets”

Santiment’s phrase “millionaire wallets” sounds like dollars, but the threshold is 1,000,000 XRP, not $1,000,000. At the price referenced by follow-up coverage, roughly $1.87 per XRP, that stash is worth about $1.87 million.

Also, “returned to the ledger” is not a guarantee of brand-new buyers. Wallets can return because of consolidation, custody reshuffles, or old addresses becoming active again. Even with that caution, the net change still matters because it shows large holders are increasing again after a period of decline.

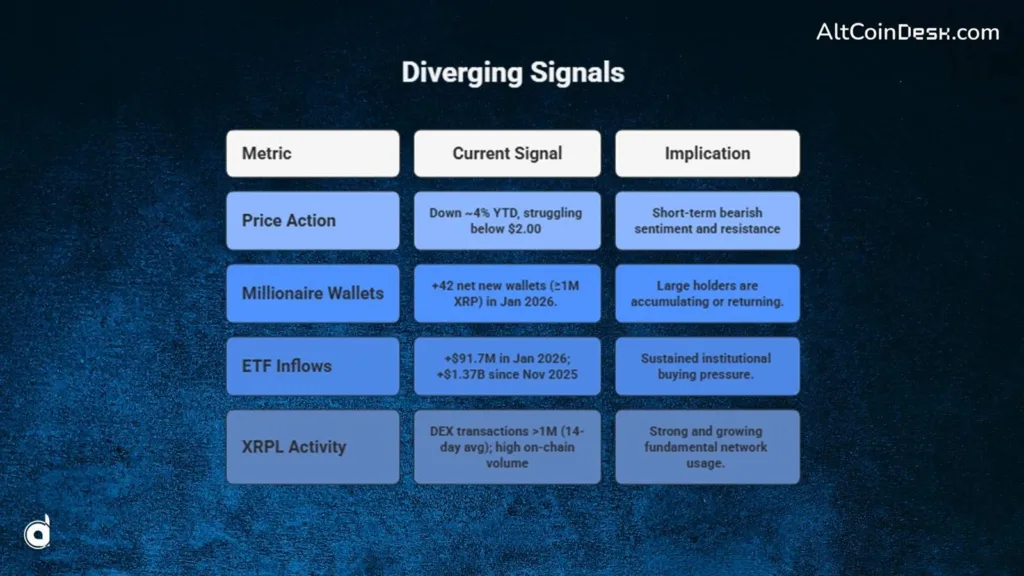

The table below summarizes the key diverging signals:

The timeline that makes this rebound meaningful

It was reported that between October and December 2025, 784 large XRP wallets holding at least 1,000,000 XRP fell below the tracking threshold or went inactive. Since the start of 2026, that decline has eased, with 42 wallets returning to the 1,000,000 XRP level, marking the first rebound since September.

Older Santiment notes show what “normal” looked like when whale confidence was stronger. In June 2025, Santiment said there were “over 2,700” whale and shark wallets holding at least 1,000,000 XRP, a milestone for the network. In July 2025, Santiment data shared on X put the count around 2,742 wallets, with those 1,000,000 XRP wallets collectively holding 47.32 billion XRP.

So the story is not “whales appeared.” The story is “whales dipped, then started rebuilding.”

Main technical angle, XRP is in liquidity compression, not collapse

When an asset keeps moving sideways, with smaller daily swings and less follow-through after each push, it often means the market is compressing liquidity. Buyers are absorbing supply without letting price run, and sellers are capping rallies without forcing a breakdown. This is why the move feels dull right before it becomes dramatic.

That is why “liquidity compression” is the cleanest way to frame the current setup for an XRP price breakout. The price is not confirmed yet, but the structure is tightening while large wallets are growing again.

Supplementary angle 1: whales are buying a range, not chasing the headline

If whales expected an immediate vertical move, you often see price displacement first, then wallet growth follows as momentum traders pile in. Here, it is the opposite. Wallet growth is improving while price is still lagging.

That behavior fits “range buying.” Large holders are comfortable accumulating inside a band, not chasing a pump. Cointelegraph’s TradingView distribution of the story framed the same point: Santiment called the rise in 1,000,000 XRP wallets an encouraging sign, even as price remained modestly down on the year.

Supplementary angle 2: The real divergence is not RSI; it is ownership

Most retail traders look for divergence on indicators. The more useful divergence here is structural. Price has not trended higher, but the count of very large wallets has turned upward again. That is a hidden divergence between price action and ownership confidence. It does not promise an instant XRP price breakout, but it does tell you this: if price pushes through resistance, there may be less supply overhead than the chart alone suggests, because accumulation already happened during the boring phase.

The levels traders are watching—keep it practical

Even without getting overly technical, the market tends to respect obvious round numbers and prior supply zones. With XRP trading around $1.88 in the coverage window, the psychological area around $2.00 is naturally a key battleground.

Also cited on a major crypto news platform was a trader who argued XRP could move toward about $2.30 if a major selling wall breaks. Treat that as a scenario, not a promise, but it gives readers a clear way to think about confirmation: an XRP price breakout needs a clean break above resistance and the ability to hold it.

What would invalidate the bullish setup?

A sober analysis needs a fail condition. If wallet growth continues but price keeps rejecting at the same resistance band, the market may simply be stuck longer than impatient traders can tolerate. More importantly, if price breaks down and stays below the established range lows, then the “compression” narrative becomes a distribution narrative.

An XRP price breakout is a thesis about pressure building. If pressure releases downward, that thesis fails until the chart rebuilds.